The Walt Disney Company Its Diversification Strategy In 2014

- The Walt Disney Company Its Diversification Strategy In 2014 Case Analysis

- The Walt Disney Company Its Diversification Strategy In 2014 Full

- The Walt Disney Company Its Diversification Strategy In 2014 Called

- The Walt Disney Company Its Diversification Strategy In 2014 Due

- The Walt Disney Company Its Diversification Strategy In 2014 2018

Blog Post #1: Critical Thinking for Business Decisions

The Walt Disney Company (NYSE:DIS) has been one of the Dow's best-performing stocks in 2012, up more than 40% YTD; this trails only Bank of America (NYSE:BAC) and Home Depot (NYSE:HD), up 67%. View The Walt Disney COmpany Its Diversification Strategy in 2014.pdf from MAN 5422 at Universitas Gadjah Mada. The Walt Disney Company: ItS Diversification Strategy in 2014 PREPARED BY KELOMPOK.

- Case 22: The Walt Disney Company: Its Diversification Strategy in 2014. Assignment Description: Complete a Case Analysis to analyze a companies Strengths, Weaknesses, Opportunities, and Threats. – The most powerful and widely used tool for diagnosing the principal competitive pressures in a market is the five forces framework.1 This framework, depicted in Figure 3.3, holds that competitive pressures.

- Moreover, Walt Disney adopted different strategies to diversify its activities and always tried to manage innovation and creativity, in order to gain the competitive edge. Furthermore, the strength of the company lies in its strong portfolio, resources, capabilities, and an effective organization.

- Them consider both forex and The Walt Disney Company Its Diversification Strategy In 2014 Case binary trading to be the same concepts. However, after reading this article, several traders would come to know that both forex and The Walt Disney Company Its Diversification Strategy In 2014 Case binary trading are two different concepts.

- Disney: Strategy Annual Report Media Networks, Experiences, and Product

- Application: Explain how critical thinking for decision making is applicable to the scenario. Use evidence to support your explanations.

- What makes critical thinking crucial for decision making?

- Analysis: Explain how information (such as facts, opinions, and published reports) is used to determine or establish the context. Use evidence to support your explanations.

- Why do you think the company reached the decision to diversify?

- What steps do you believe were taken? Explain your response using sources found during the research of your selected company.

- Conclusion and related outcomes: Describe the role of logic, evidence, and arguments in the company’s decision-making process.

- Was the decision to expand products, services, or value chain successful? Why or why not?

Walt Disney Corporation

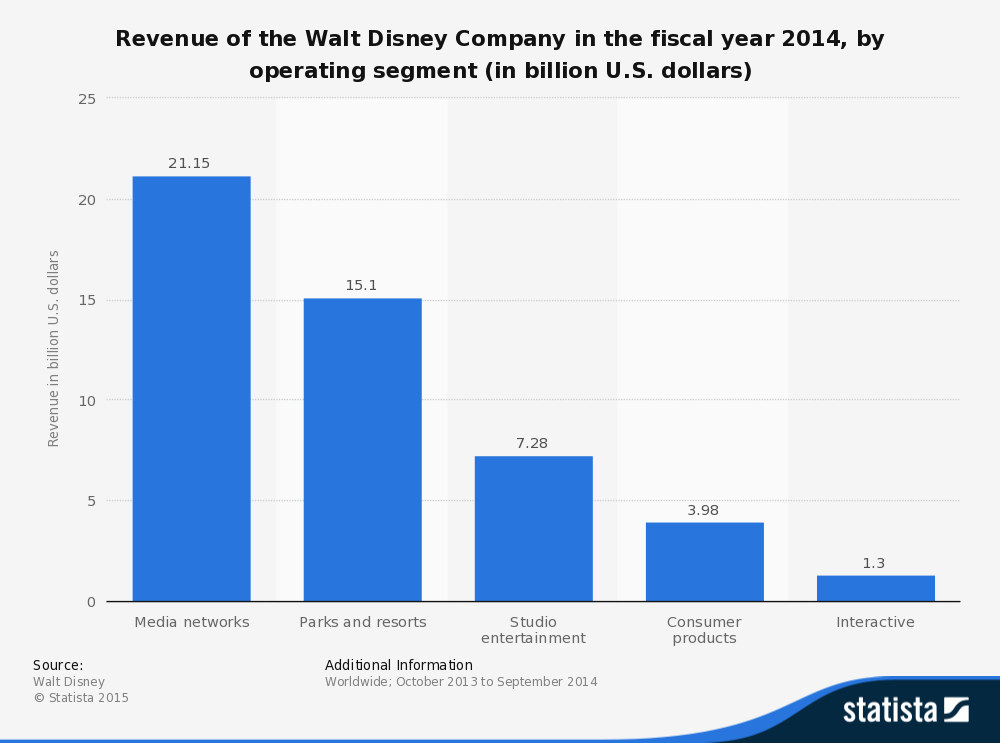

The Walt Disney Corporation has long been a worldwide entertainment giant that now “operates in four business segments: Media Networks, Parks Experiences and Products, Studio Entertainment, and Direct-To-Consumer and International” (Reuters, 2020). Their movies, products, and theme parks have a worldwide appeal to people of all ages and backgrounds, as their consumer base does not have any limitations or hinderances. “The mission of the Walt Disney Company is to entertain, inform and inspire people around the world through the power of unparalleled storytelling, reflecting the iconic brands, creative minds and innovate technologies that make ours the worlds’ premier entertainment company” (Walt Disney, 2020).

Analysis–Critical Thinking Application

Now that we see the mission statement of Walt Disney and the restructuring they went through in order to strategically position their business for the future, the reason behind the company restructuring can be examined. As a company looks to restructure their business and diversify, they are searching for ways to add customer value to their products and services while entering into new industries. To realize that restructuring is a company objective, critical thinking plays a role in the formation of this idea and how to implement such an aggressive and potentially profitable strategy. “Critical thinking skills help you identify the problem or goal, brainstorm solutions, interpret data correctly, weigh the options logically, and efficiently organize the implementation and revision of your plan” (Soomo Learning, 2020). Disney viewed their restructuring as a business operations goal and not a problem. The stated objectives for the diversification efforts from Walt Disney CEO were focused on “creating a more effective, global framework to serve consumers worldwide, increase growth, and maximize shareholder value” (Walt Disney, 2018). The overall theme remains adding customer value. These business objectives are very specific and deliberate decisions aimed towards maximizing customer value. Critical thinking skills are crucial for the decision making process because as you gather information about the stated problem or goal, your focus and priority become choosing the best path for implementing ways to reach specific business objectives.

Decision for Diversification

In order to reach the decision of diversification, Disney used critical thinking in order to identify what their company can do better than other company’s within the new industries they would be entering into. The steps takes to achieve this included exploring just how they would be able to gain and maintain a competitive advantage. “Before diversifying, managers must think not about what their company does but about what it does better than its competitors” (Markides, 1997). I think that Walt Disney realized that within their global entertainemnt corporation, they already had the infrastructure and the competitive advantages to be able to enter into different industires without really disrupting their own internal business operations. Our text states that this type of a diversification strategy is called related diversification. “Related diversification occurs when a firm moves into a new industry that has important similarities with the firm’s existing industry or business lines” (Soomo Learning, 2020). Instead of continuing to house the different business opportunities like media, theme parks, and products under one corporate umbrella, it made sense financially to diversify into the corresponding industries. This decision has enhanced and also solidified the sustainability of Walt Disney as the company moves forward with its mission statement of using innovatite technology and their brands to remain a world leader in entertainment.

Conclusion

Pandemic aside, the decision for Walt Disney to diversify their entertainment corporation has been the right decision financially. Because of the pandemic we are currently experiencing, “Walt Disney’s diversified entertainment and media portfolio hit a major snag in the latest quarter, as the coronavirus pandemic impacted practically every business that Disney operates in around the globe” (Jasinski, 2020). Movie production came to a halt, theme parks and cruises were forced to cease operations, and retail sales of product were way down. The only area where Disney saw any gains financially was in their streaming platforms, but that did not makeup for the gigantic losses in their other sectors. “Management estimated that Covid-19 took a nearly $3 billion bite out of Disney’s operating income in the [third-quarter] period” (Jasinski, 2020).

Before the pandemic, we can point to Walt Disney’s year over year revenue growth to support the company’s decision to reorganize. The reorganization of the company was announced in March of 2018. If we look at some historical data of year to year revenue growth, we can see that the decision has been profitable.

“Disney annual revenue for 2017 was $55.137B, a .89% decline from 2016” (“Disney Revenue”, 2020).

The Walt Disney Company Its Diversification Strategy In 2014 Case Analysis

“Disney annual revenue for 2018 was $59.434B, a 7.79% increase from 2017” (“Disney Revenue”, 2020).

“Disney annual revenue for 2019 was $69.57B, a 17.05% increase from 2018” (“Disney Revenue”, 2020).

The Walt Disney Company Its Diversification Strategy In 2014 Full

Each business under the Walt Disney corporation is serving a different market and customer. Making the theme parks and products into one business has been the best decision financially as “combined, consumer products and theme parks would overtake television to become Disney’s largest business” (Fritz, 2018). By reorganizing their company, Walt Disney successfully diversified their company portfolio and better positioned themselves in the markets and industries in which they already served.

References

Disney Revenue – 58 Year Stock Price History: DIS. (2020). Retrieved from https://www.macrotrends.net/stocks/charts/DIS/disney/stock-price-history

Fritz, B. (2018, March 14). Disney Overhaul Sets Stage for Succession Race. Retrieved from https://www.wsj.com/articles/walt-disney-co-unveils-strategic-reorganization

Jasinski, N. (2020, August 05). Disney Earnings Were Better Than Feared. Its Stock Is Jumping. Retrieved from https://www.barrons.com/articles/disney-stock-earnings-them-parks-streaming-movies-sports-espn-51596576584

Markides, C. C. (1997, November/December). To Diversify or Not To Diversify. Retrieved from https://hbr.org/1997/11/to-diversify-or-not-to-diversify

The Walt Disney Company Its Diversification Strategy In 2014 Called

Reuters. (2020). DIS.N – Walt Disney Co Profile. Retrieved from https://www.reuters.com/companies/DIS.N

Soomo Learning. (2020). Critical business skills for success. https://www.webtexts.com

The Walt Disney Company Its Diversification Strategy In 2014 Due

The Walt Disney Company. (2020, August 28). The Walt Disney Company. Retrieved from https://thewaltdisneycompany.com/

The Walt Disney Company Its Diversification Strategy In 2014 2018

The Walt Disney Company Announces Strategic Reorganization. (2018, June 27). Retrieved from https://thewaltdisneycompany.com/walt-disney-company-announces-strategic-reorganization/